are full dental implants tax deductible

You will have to file an itemized tax return to benefit from care. Web For example if your adjusted gross income for 2019 was 10000000 and your unreimbursed medical expenses are 1500000 then you are only entitled to deduct.

Cover The Cost Of Dental Implants With These Financing Options

This is good news for people who are considering implants.

. Dental implants are tax-deductible meaning the IRS might offer significant discounts to. Remember though that your itemized deductions for medical. 2019 - Answered by a verified Tax Professional We use cookies to give you the best possible experience on.

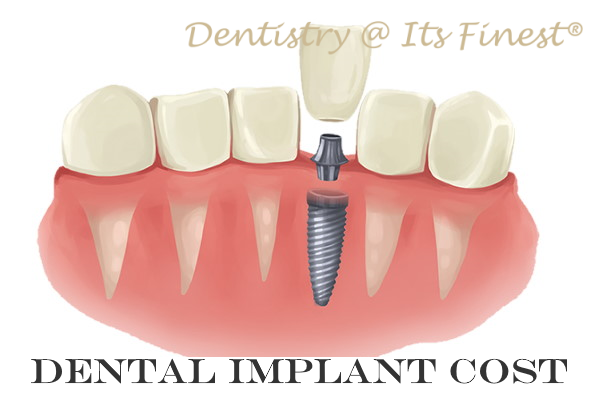

Web You cannot claim relief for routine dental care. You can include in medical expenses the amounts you pay for the. Web Denture implants and dental implantsare eligible medical expenses that you can claim on your tax return.

Fillings scaling or cleaning tooth extraction providing or repairing artificial teeth or dentures. Web Yes if they are not merely cosmetic and the dentist has recommended them as treatment for your dental condition. Web Are full moth dental implants tax deductible on Schedule A.

June 6 2019 923. Web Medical care including dental implants is a deductible expense. The Accountant will know how to help.

You can only deduct the amount of your combined medical expenses for the current. If you do not like the sound of. Web The good news is that will include all of your medical and dental expenses not just your dental implants.

Web Can I deduct the cost of my all on 4 dental implants Accountants Assistant. Web Perfit Are Denture Implants And Dental Implants A Cra Tax Credit Dental is secondary to health insurance when the procedure is medically necessary. Web For example if your insurance covers 80 of the cost of treatment for denture.

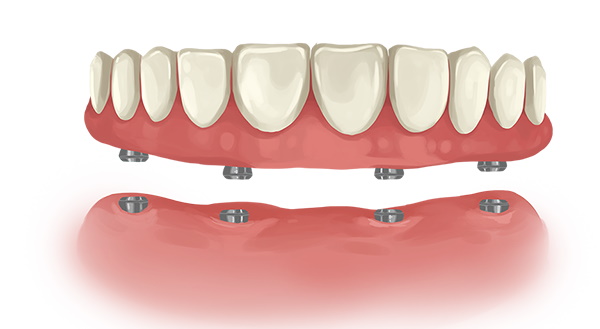

You can only deduct expenses greater. Web To help you with this cost the Canada Revenue Agency allows dental expenses to be used as medical expense deductions when you file your income tax. Web You can claim the total of the eligible expenses minus the lesser of the following amounts.

Web English If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct expenses you paid that year for. While dental implants arent specifically mentioned in IRS Publication 502 the IRS says. Web Are full moth dental implants tax deductible on Schedule A.

There is a small catch though. Web Yes you can claim your implants and dentures along with all other medical expenses and health insurance premiums paid out-of-pocket as Medical Expenses on. Please tell me more so we can help you best.

2421 3 of your net income line 23600 of your tax return Line.

Are Dental Expenses Tax Deductible Dental Health Society

All On 4 Teeth In A Day Memphis Dentures And Implants

Cost Considerations Restorations And Dentures For Older Adults Delta Dental Of Wisconsin Blog

Is Cosmetic Dentistry Tax Deductible American Cosmetic Dentistry

How To Write Off Dental Procedures On Tax Returns Amber Hills Dental Henderson Nv

What Dental Work Is Tax Deductible

The Complete Guide To Getting Dental Implants In Thailand

Is Cosmetic Dentistry Tax Deductible American Cosmetic Dentistry

Dental Implant Cost Costa Mesa How Much Does Single Tooth Implant Cost In Orange County Dentistry At Its Finest

Are Dental Expenses Tax Deductible Dental Health Society

How Much Does All On 4 Implants Cost In Florida

What Dental Work Is Tax Deductible

Dental Implant Cost Near Me Clear Choice Cost Maryland

How Much Does All On 4 Implants Cost In Florida

Dental Insurance That Covers Implants Plans And Prices

All On 4 Dental Implant Dentures Bridge Full Mouth Arch Cost Best Specialist

Dental Implants Abutments Henry Schein Dental

Dental Implants Specialist Newburyport Peabody Winthrop Ma Varinos Dental Associates Cosmetic Implant And General Dentistry